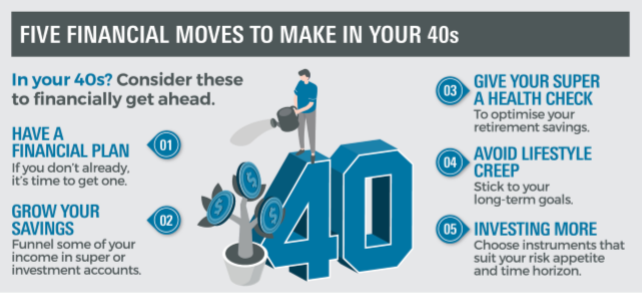

In your 40s? Here’s what you need to consider to financially get ahead.

Being in your 40s often involves balancing many responsibilities that it becomes easy to neglect your own financial wellbeing. But it’s not too late to secure your future. Here are some tips that may help you financially make the most of your 40s.

1. Create a plan

If you don’t have a financial plan, it’s time to get one. Ensure that it’s based on your needs and priorities. By working with a professional adviser, you may be able to tailor a plan that helps you optimise your ability to save and invest.

2. Grow your savings

Your 40s could be your peak earning years, so it may be a good idea to ramp up your savings and funnel some of your income into your superannuation or investment accounts. But be sure to do your homework and consult with a professional financial adviser about your options.

3. Give your super a health check

A quick super health check may help you optimise your retirement savings. For example, by choosing a different investment option or type of risk, you may be able to earn better returns on your super. If you have multiple funds, consolidating your accounts may help you save on fees. Again, seek advice from a professional adviser before acting.

4. Avoid lifestyle creep

People generally have a tendency to inflate their standard of living as they earn more and can afford more things, such as a better car or house. While it’s only natural to want the finer things in life, you’ll likely end up with little to no financial gain if your spending rises as quickly as your income. Try stick to your long-term financial goals and remember the big picture.

5. Consider investing more

Your 40s may be a good time to invest more – or diversify your investments – to help you grow your long-term savings. But keep in mind that it’s important to choose instruments that suit your risk appetite and time horizon. Developing a strategy with your financial adviser might make it easier achieve the return required to reach your financial goals.

Consultum Financial Advisers Pty Ltd (Consultum) | ABN 65 006 373 995 | AFSL 230323

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or seek advice from a financial adviser and seek tax advice from a registered tax agent. Information is current at the date of issue and may change. You should obtain a copy of the Product Disclosure Statement available from the product provider or your financial adviser and consider this before you acquire a financial product. This information and certain references, where indicated, are taken from sources believed to be accurate and correct. To the extent permitted by the Law, Consultum, its representatives, officers and employees accept no liability for any person that relies upon the information contained herein. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.